3 Long-Term CD Moves to Make With Interest Rates Paused This August

3 Long-Term CD Moves to Make With Interest Rates Paused This August

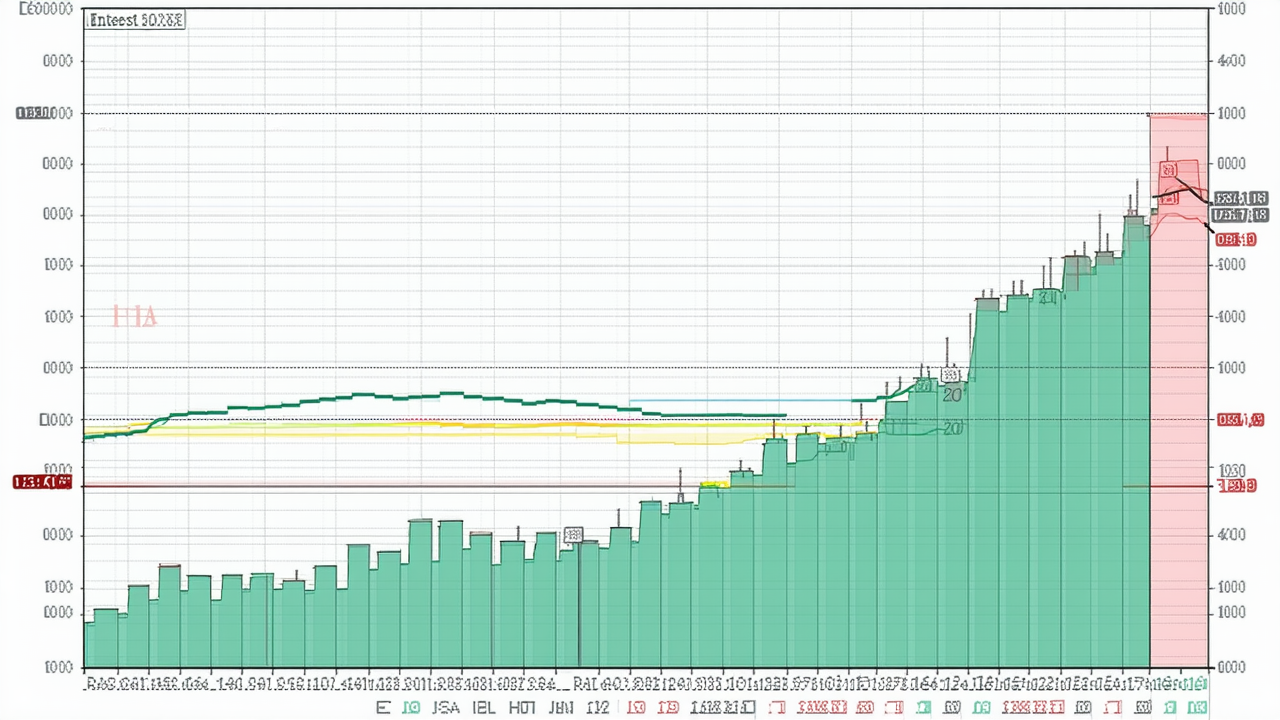

With interest rates on pause this August, savers have a unique opportunity to make strategic moves with long-term certificates of deposit (CDs). As the Federal Reserve keeps its federal funds rate high, now is the time to take advantage of the current environment and secure better returns on savings. These are three key actions that savers should consider to maximize their earnings and protect their financial future.

1. Deposit as Much as You Can for as Long as Possible

One of the most effective moves for long-term CD holders is to deposit the maximum amount possible for an extended period. Although short-term CD rates are currently higher than long-term ones, the longer time horizon of long-term CDs can result in significantly higher overall returns. This is especially true when rates are stable, as the extended earning period allows savers to lock in high interest rates for a longer time.

However, it's important to ensure that this deposit doesn’t jeopardize your daily budget or expose you to early withdrawal penalties. Before committing, evaluate your financial needs and determine how much you can comfortably invest without affecting your ability to cover essential expenses.

2. Use August to Shop Around for a High Rate

With interest rates remaining on pause at least until mid-September, savers have a window of opportunity to shop around for the best long-term CD deals. This is particularly beneficial for those who might have previously rushed into a CD without thoroughly comparing options.

Online banks often offer more competitive rates than traditional brick-and-mortar institutions due to lower overhead costs. Taking the time to compare offers from multiple banks, especially online ones, can help savers secure a higher interest rate and better terms for their long-term CDs.

3. Re-Evaluate Where Your Other Money Is Being Held

Not all savings accounts are created equal. With long-term CDs currently offering rates of around 4%, it's worth re-evaluating where your money is being held and considering a shift into these higher-yielding accounts. Traditional savings accounts typically offer much lower rates, and high-yield savings accounts are subject to fluctuations that could reduce returns as interest rates change.

By moving your money into long-term CDs now, you can lock in a stable, predictable return that could outperform other savings vehicles, especially as interest rates remain on pause. This move can help you grow your savings over time while minimizing the risk of losing money due to rate declines.

The Bottom Line

Although these three moves are not exhaustive, they form a solid starting point for savers looking to take advantage of the current pause in interest rates. By making these strategic decisions now, savers can protect and grow their money over the next 18 months or longer, offering a sense of security in an otherwise unpredictable financial environment.

With the current rate environment, now is the time to act. Consider how these steps can align with your financial goals and take the necessary actions to secure your savings for the future.