Ingham's Chicken Brand Faces $50M Tax Dispute with Australian Tax Office

Ingham's Chicken Brand Faces $50M Tax Dispute with Australian Tax Office

By Daniel Ziffer, ABC Business Reporter

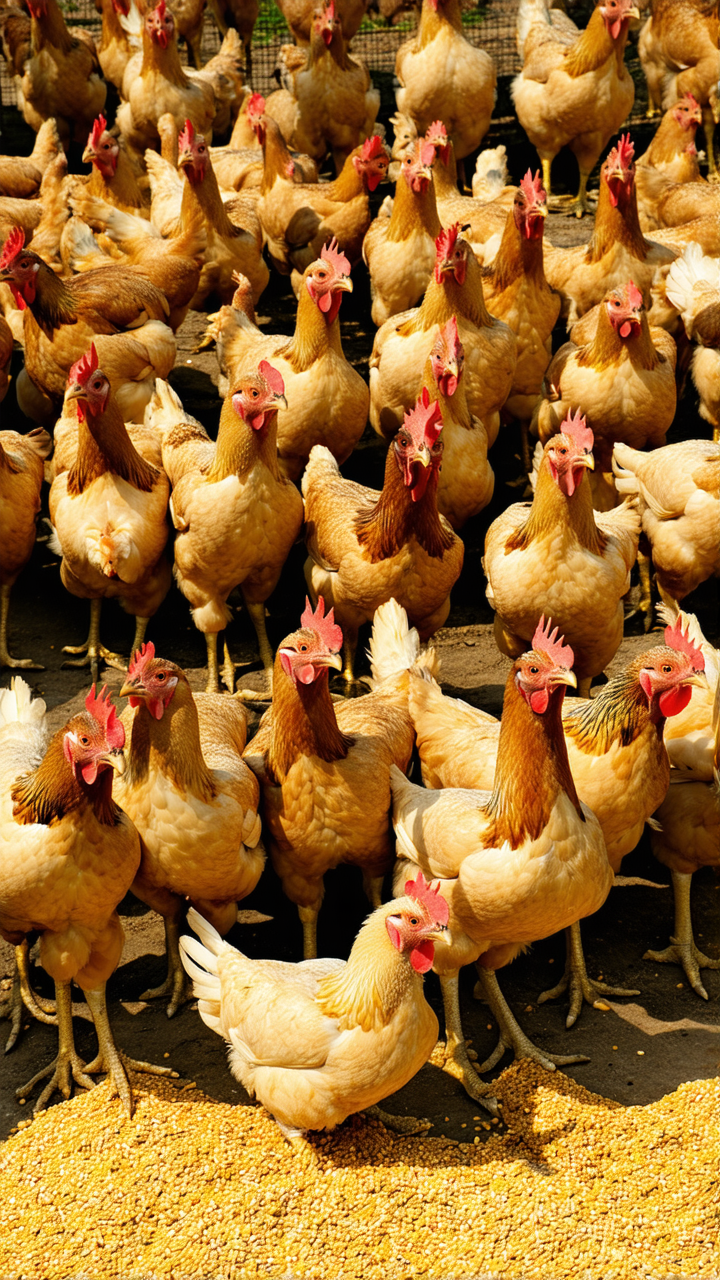

In a long-running legal battle that has spanned six years, Australia's prominent poultry brand Ingham's is locked in a high-stakes dispute with the Australian Taxation Office (ATO) over a potential $50 million claim for research and development (R&D) tax offsets.

The dispute centers around whether Ingham's R&D activities—specifically related to its chicken feed—qualify for the generous tax incentives offered by the government to encourage innovation. The ATO has accused the company of potentially misrepresenting its R&D efforts, which, if found true, could lead to a significant reduction in the tax benefits claimed by Ingham's.

Ingham's, which has been in operation for over a century and is one of Australia's largest chicken processors, has strongly denied the allegations. The company has stated that it will 'vigorously defend its position' and is prepared to take the matter to court if necessary.

The dispute has raised broader questions about the R&D tax incentive program, with experts pointing out that Australia's R&D investment is significantly lower than that of other developed nations. Currently, Australia spends just 1.68% of its GDP on R&D, well below the OECD average of 2.7% and far behind countries such as South Korea (over 4%) and Japan (3.3%).

The R&D Tax Incentive: A Double-Edged Sword

The R&D tax incentive program is designed to encourage companies to invest in innovation by offering significant tax benefits. However, the program has also faced criticism for being too loosely defined, leading to disputes like the one involving Ingham's.

According to legal expert Piotr Klank, the ambiguity in the R&D criteria often leads to disputes. 'One of the things about research is that the activities can change as you're going along,' he explained. 'But while things may change, that 'advanced finding' will apply to the project that you have registered.'

Ingham's has not applied for an 'advanced finding' before initiating its R&D activities, a process that allows companies to get pre-approval for their R&D claims. Most companies, according to Klank, tend to apply for R&D incentives after the fact rather than before, complicating the process and increasing the likelihood of disputes.

What's at Stake?

If the ATO's allegations are proven, Ingham's could face a substantial reduction in the tax benefits it has claimed over the past six years. The dispute also highlights the challenges faced by companies trying to navigate a complex and often ambiguous R&D tax framework.

Meanwhile, the ATO has not commented on the specific details of the dispute, citing statutory confidentiality obligations. However, the ATO has emphasized that it has 'sophisticated systems' in place to detect potential non-compliance with the R&D tax incentive program.

A Call for Greater Clarity

Experts like Dr. Penny Wood, who has previously assessed R&D tax rebate applications, have called for greater clarity in the R&D tax incentive program. 'It has to be genuinely different, innovative — changing either the way we do things, changing a product itself in a substantive way,' she said.

As the dispute continues, it has become a focal point for broader discussions about the future of R&D investment in Australia and the need for a more transparent and effective tax incentive program.