KiwiSaver Hardship Withdrawals Reveal Hidden Cost of Economic Downturn

KiwiSaver Hardship Withdrawals Reveal Hidden Cost of Economic Downturn

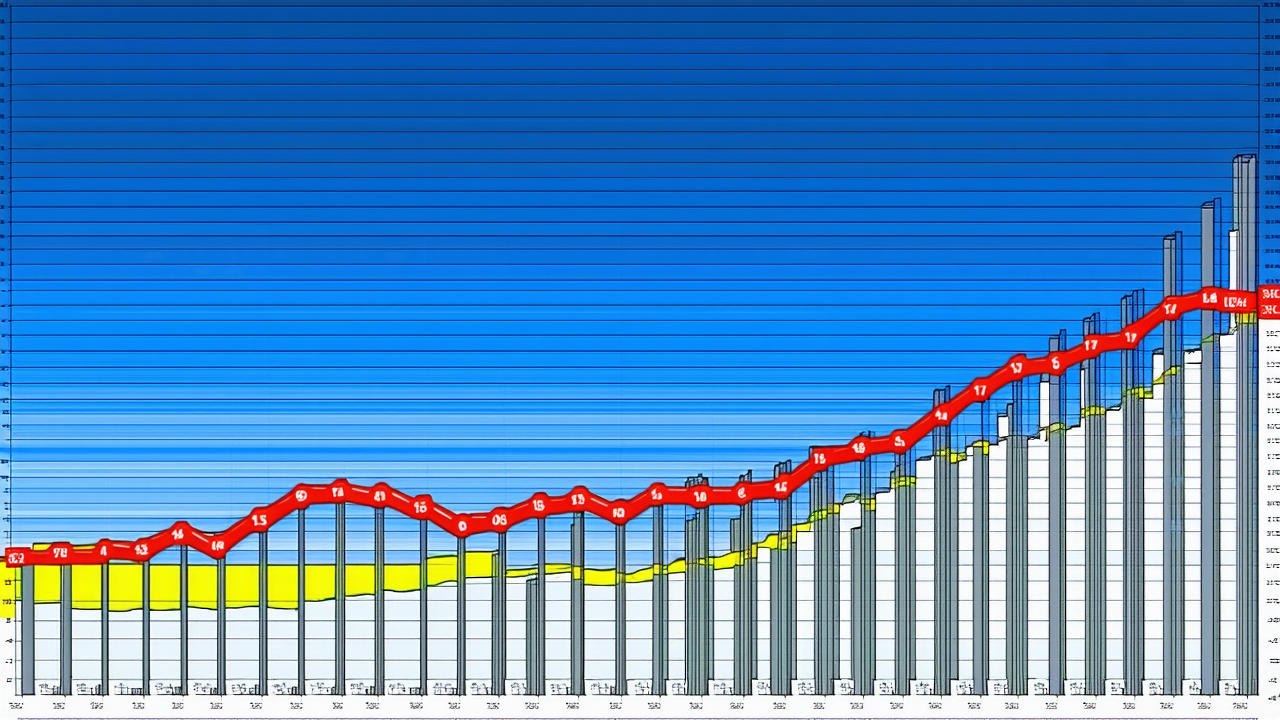

As the economic downturn continues to stretch on, New Zealanders are increasingly turning to their KiwiSaver accounts for financial relief. In the past year alone, more than $470 million has been withdrawn for hardship reasons, marking a 56.6% increase compared to the previous year. With this trend continuing, the long-term consequences for the nation’s retirement savings are becoming increasingly apparent.

According to Inland Revenue data, over $1.3 billion has been taken out of KiwiSaver accounts for hardship reasons in the past five years. If this money had remained invested, it could have generated significant returns over time. Assuming an average 7% annual return, the total shortfall in retirement savings by 2045 could exceed $5 billion. This figure is likely a conservative estimate given the current trajectory of withdrawals.

While hardship withdrawals are understandable in times of financial crisis, they come at a steep cost to the future of New Zealand’s retirement savings. The government has recognized the importance of allowing such withdrawals, as many individuals would face severe hardship without access to their savings. However, this raises a critical question: how can the nation ensure that future generations are not left with a significant gap in their retirement funds?

Statistics New Zealand projects that the proportion of the population aged 65 and over will rise from 16-17% in the early 2020s to around 24-26% by 2050. This demographic shift is expected to significantly increase the financial burden on the government, with New Zealand Superannuation costs projected to rise from over $20 billion annually to around $45 billion by 2037. This growing fiscal challenge underscores the importance of strengthening retirement savings now.

KiwiSaver, which currently holds $122 billion in total funds, is a vital component of New Zealand’s retirement strategy. However, with more than three million members, the average KiwiSaver balance is only $37,000. This highlights the need for more robust savings practices, particularly among younger workers who have the potential to significantly increase their savings over time.

The government has taken steps to address the issue by increasing the default contribution rate to 4% for both employees and employers starting in 2028. However, these measures fall far short of the mandatory 12% employer contributions required in Australia’s superannuation scheme. This discrepancy may be contributing to a brain drain, with some young Kiwis opting to work in Australia and join its more generous retirement savings system.

As the nation grapples with the long-term implications of current financial trends, it is clear that a more comprehensive approach to retirement savings is needed. This includes not only increasing contribution rates but also addressing the root causes of financial hardship that lead to early withdrawals from KiwiSaver accounts.

With the retirement landscape changing rapidly, the time to act is now. Failing to strengthen KiwiSaver and other retirement savings mechanisms could leave future generations facing a severe shortfall in their financial security. The challenge is not just about saving more, but ensuring that these savings are protected and allowed to grow over time.