New Zealand Inflation Rises 2.7% Annually, But Quarterly Increase Falls Short of Expectations

New Zealand Inflation Rises 2.7% Annually, But Quarterly Increase Falls Short of Expectations

Inflation in New Zealand has climbed to 2.7% over the 12 months ending June 2025, according to data released by Statistics New Zealand. However, the quarterly increase of 0.5% was below market expectations, which had anticipated a rise of 2.8% or 2.9%. This development has sparked renewed discussions around potential interest rate cuts by the Reserve Bank of New Zealand (RBNZ) in the coming months.

Lower Petrol Prices Provide Some Relief

One of the key factors contributing to the lower-than-expected quarterly increase was a 8% drop in petrol prices over the past year. This decline helped offset rising costs in other areas, including food and local authority rates, which climbed by 12.2% annually. ASB senior economist Mark Smith noted that the data has "paved the way" for the RBNZ to consider reducing the official cash rate (OCR) in August, potentially by 25 basis points to 3%.

Core Inflation Remains a Focus for the RBNZ

While annual inflation is expected to rise above 3% in the September 2025 quarter, the RBNZ is likely to focus on core inflation, which excludes volatile items like petrol and food. Westpac senior economist Satish Ranchhod said that core inflation has been gradually declining and is now within or near the RBNZ's target range of 2% to 3%.

Market Reactions and Economic Outlook

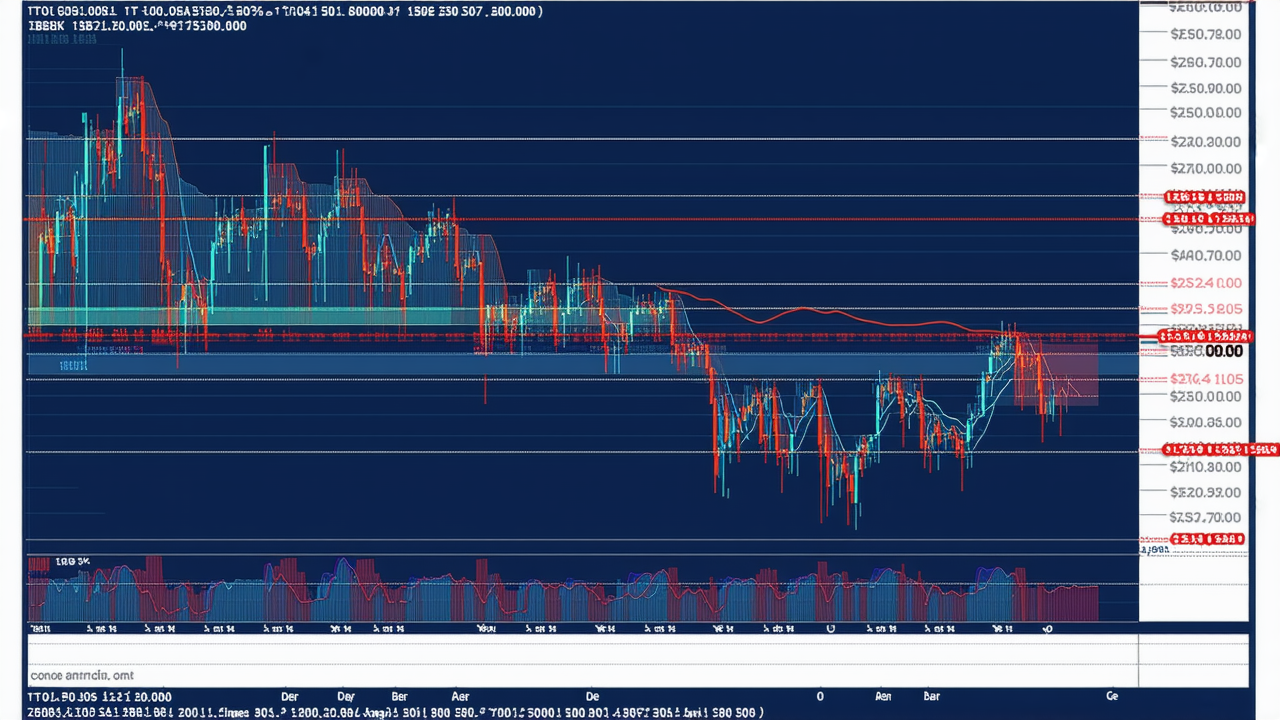

The release of the data led to a slight weakening in the New Zealand dollar and wholesale interest rates. The NZ dollar fell to US59.45c, and two-year swap rates dropped 3.5 basis points to 3.16%. BNZ senior market strategist Jason Wong said the results provided some reassurance that the RBNZ will likely ease monetary policy again, in line with the consensus view.

Cultural Services See Sharp Increase

The largest upward contributor to the quarterly inflation rate was the cultural services category, which rose by 9.5% due to increased spending on streaming subscriptions. This category accounted for 26% of the 0.5% quarterly increase in the CPI.

Uncertainty Remains in Discretionary Spending

However, uncertainty remains regarding the future of inflation, particularly in the area of discretionary household spending. Items such as clothing, furniture, and other durable goods are mostly imported, and their price trends could be volatile. Recent subdued consumer spending may further dampen inflationary pressures, but sharp fluctuations in sectors like automotive could also impact core inflation metrics.

Conclusion

As the RBNZ continues to monitor economic conditions, the balance between inflation control and support for the slowing economy remains a key challenge. While the recent data may provide some breathing room for policymakers, the path ahead remains uncertain and will require careful navigation.